Worker Retraining at Community and Technical Colleges

The Worker Retraining program provides dislocated workers and the long-term unemployed with access to job retraining for a new career. Program enrollments vary from year to year in response to layoffs. During recessions the need increases. The industries from which students are laid off also vary over time. About one percent of worker retraining students receive their training at private career schools. This evaluation, however, is limited to training at the state’s 34 community and technical colleges. The colleges provide training in occupational skills and basic skills and literacy. Qualifying students may receive financial assistance to help with their tuition.

State Core Indicator Results

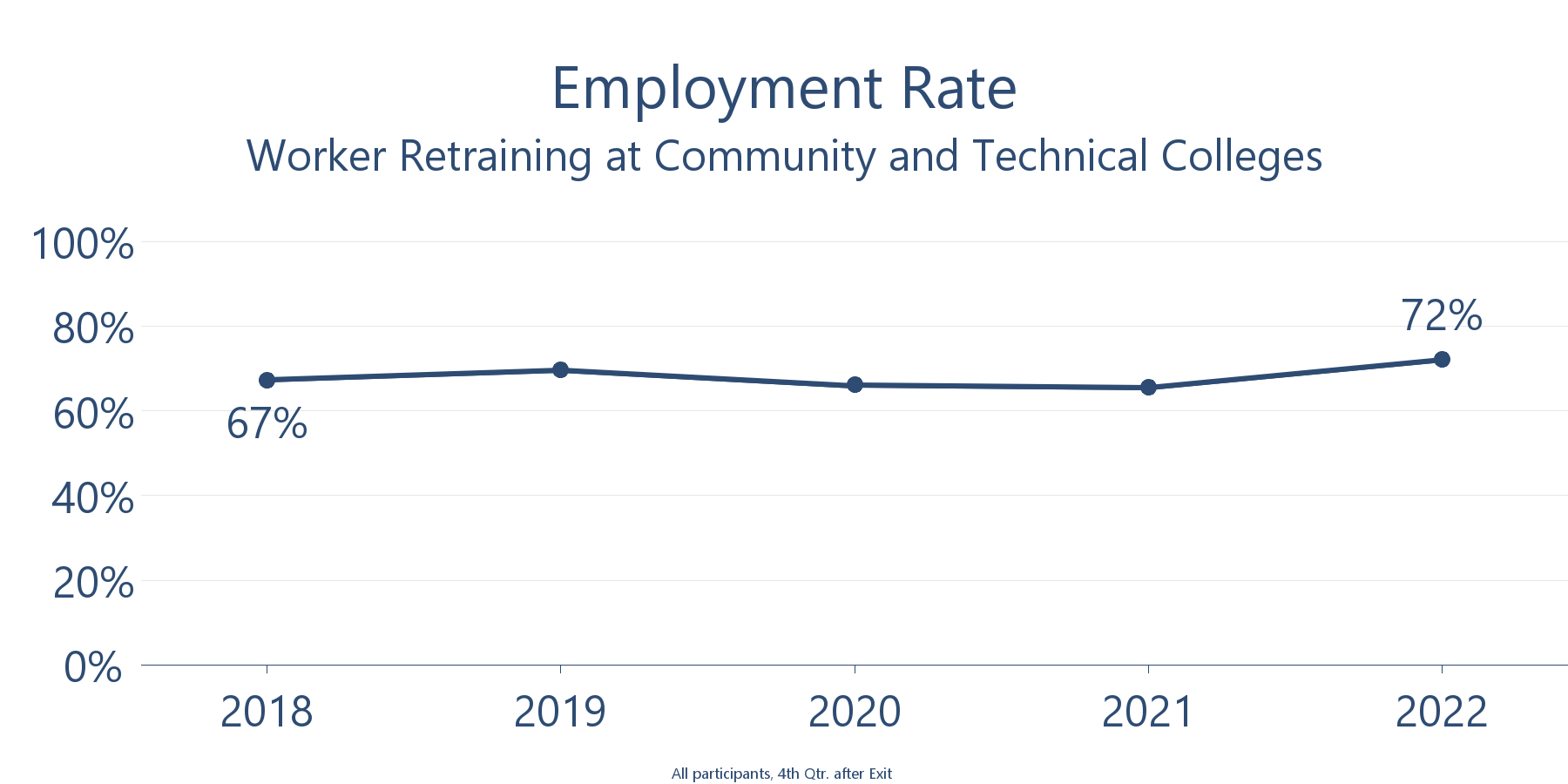

| Employment Percentage of participants who were employed a year after leaving the program.* |

All 72% Completers 74% |

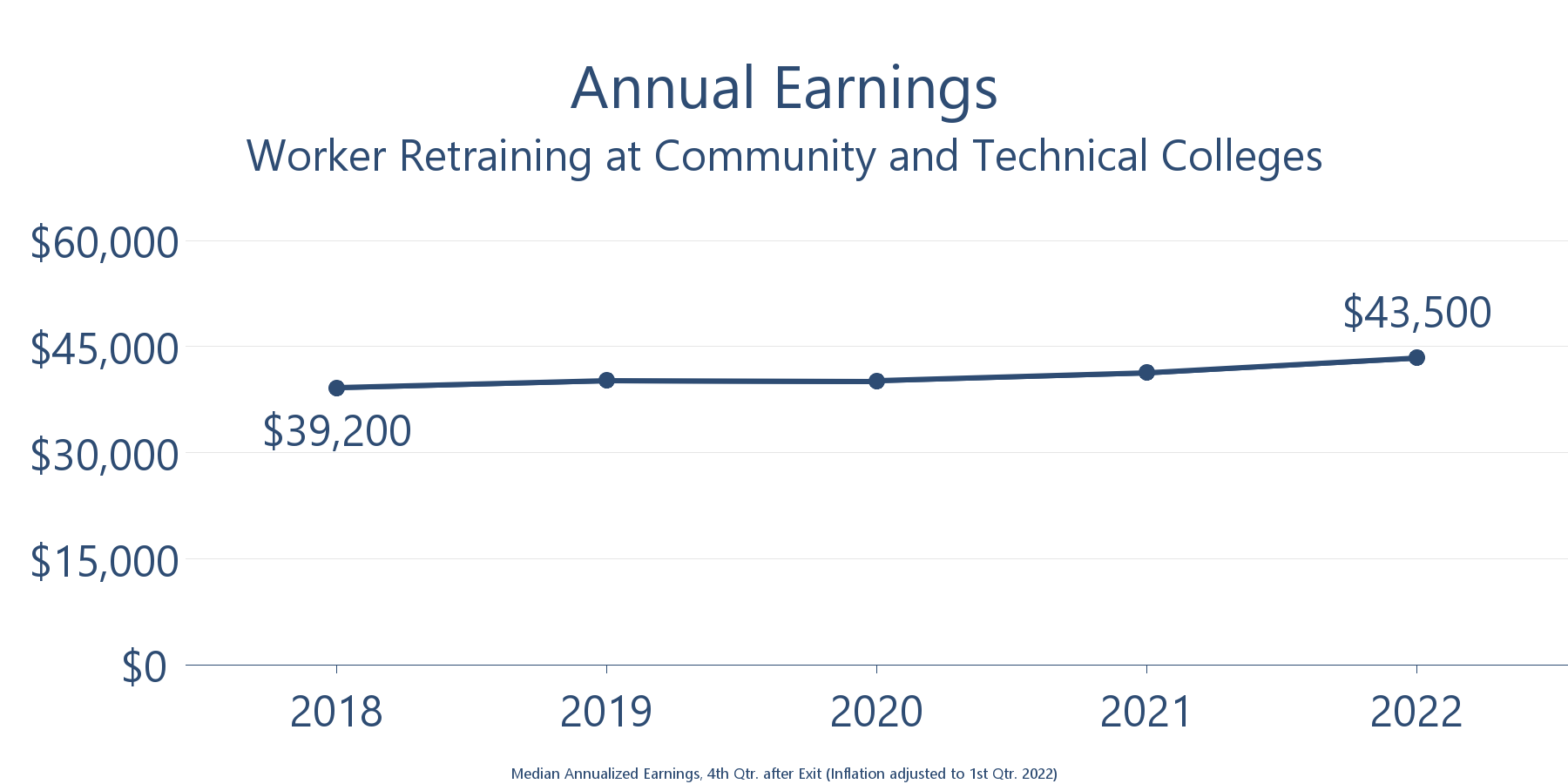

| Earnings Median annualized earnings nine to 12 months after leaving the program. (Quarterly earnings are the result of hourly wage rates and the number of hours worked in a calendar quarter. To derive annualized earnings, quarterly earnings are multiplied by four.) |

All $43,500 Completers $44,500 |

| Skills Percentage of participants who obtained an appropriate credential. (Percentage based on all participants, including those who did not receive training through the program.) |

62% |

| Net Participant Benefits Average additional yearly earnings plus benefits (such as health insurance, paid vacation, and sick leave). Overall benefits are calculated by subtracting tuition costs, foregone earnings while in a workforce program, reduced government assistance, and increased taxes because of higher earnings. |

$7,500 |

| 10-Year Economic Impact Total net economic benefit over 10 years generated by workforce programs as a result of increased employment, increased net earnings, and reduced government assistance, minus total program costs and tuition. |

$284 million |

| 10-Year Taxpayer Return on Investment Net return on investment to taxpayers over 10 years from publicly funded workforce programs due to increased tax revenue resulting from increased earnings and reduced government assistance. |

$2.90 to 1 |

*Does not include data on self-employment.