WorkFirst

Washington’s welfare-to-work program is based on the 1996 federal Temporary Assistance to Needy Families (TANF) welfare reform legislation. The aim of WorkFirst is to help low-income families become self-sufficient by providing training and support services necessary for parents to get a job, keep a job, and move up a career ladder. This study is limited to WorkFirst participants who enrolled in an employment or training component.

State Core Indicator Results

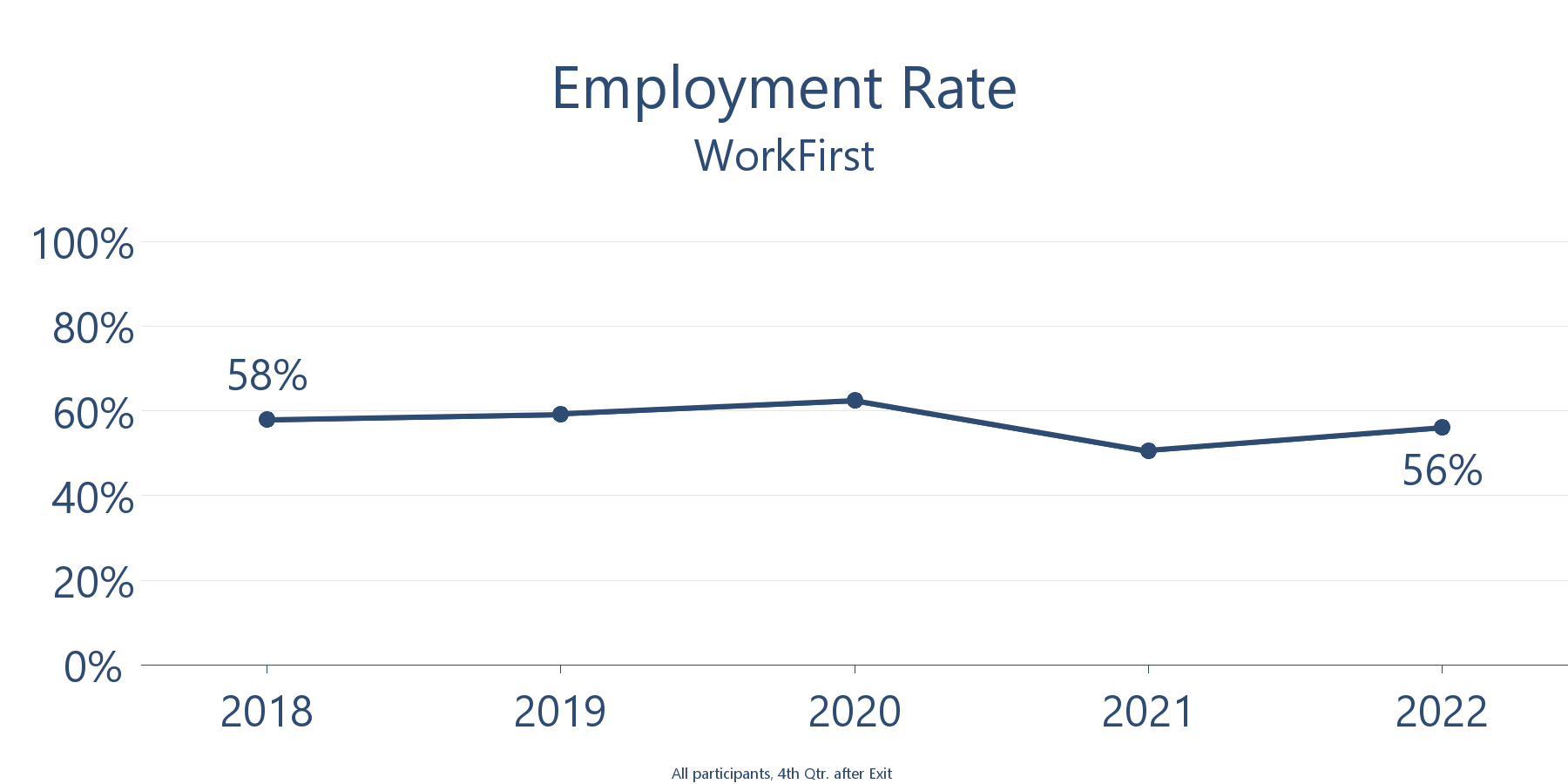

| Employment Percentage of participants who were employed a year after leaving the program.* |

56% |

| Earnings Median annualized earnings nine to 12 months after leaving the program. (Quarterly earnings are the result of hourly wage rates and the number of hours worked in a calendar quarter. To derive annualized earnings, quarterly earnings are multiplied by four.) |

$24,000 |

| Skills Percentage of participants who obtained an appropriate credential. (Percentage based on all participants, including those who did not receive training through the program.) |

N/A |

| Net Participant Benefits Average additional yearly earnings plus benefits (such as health insurance, paid vacation, and sick leave). Overall benefits are calculated by subtracting tuition costs, foregone earnings while in a workforce program, reduced government assistance, and increased taxes because of higher earnings. |

$2,300 |

| 10-Year Economic Impact Total net economic benefit over 10 years generated by workforce programs as a result of increased employment, increased net earnings, and reduced government assistance, minus total program costs and tuition. |

$91 million |

| 10-Year Taxpayer Return on Investment Net return on investment to taxpayers over 10 years from publicly funded workforce programs due to increased tax revenue resulting from increased earnings and reduced government assistance. |

$-0.30 to 1 |

*Does not include data on self-employment.